Real Google Ads Price Per Month USA 2025: $10k–$150k – If You Can’t Afford It, Delete Your Business Right Now

Best Enterprise SEO Agency in 2026

November 13, 2025

Purchase SEO For Perfect Enterprise Company , Or You Either You Dominate Page 1 or You Die on Page 10 Forever

December 8, 2025Real Google Ads Price Per Month USA 2025: $10k–$150k – If You Can’t Afford It, Delete Your Business Right Now. Google Ads Price Per Month in USA Just Skyrocketed – Pay Now or Watch Your Competitors Eat Your Lunch. You’re Still Guessing Google Ads Cost Per Month in USA? Your Rival Just Locked in $8k/month and Stole Your Customers.

Google Ads Monthly Cost USA Just Hit All-Time High – Book Your Budget Today or Cry on Page 2 Forever. Your Competitor Is Spending $25,000/month on Google Ads in USA While You’re ‘Thinking About It’ – Good Luck.

Google Ads Price Per Month USA 2025 Exposed: Pay $15k–$100k or Keep Burning Money on Instagram Reels. Stop Asking ‘How Much Is Google Ads Per Month in USA’ – Start Paying or Start Closing Your Business. Google Ads Cost Per Month USA 2025: Either You Pay $20k/month Like a Boss or You Die in Organic Traffic Hell.

The Brutal Truth: Google Ads Price Per Month in USA Is Now $12k Minimum – Can You Handle It or Not? Google Ads Monthly Budget USA Winners vs Losers List Dropped – Guess Which Side You’re On Right Now. If You’re Not Spending Minimum $15k/month on Google Ads in USA in 2025, Just Shut Down Your Website.

Google Ads Price Per Month USA Just Went Nuclear – Lock Your Campaign Today or Get Ready to Print Money. You Think Google Ads Is Expensive? Wait Until You See How Much It Costs to Stay Invisible in 2025. Google Ads Cost Per Month USA 2025: $8,000 – $200,000 – Choose Your Fighter or Choose Bankruptcy.

Your Competitor Just Raised Google Ads Budget to $50k/month – What’s Your Move, Bro?

Google Ads Price Per Month USA 2025–2026: The Brutal Numbers No Agency Wants You to See

Let’s cut the bullshit.

You landed here because you’re tired of fluffy answers like “it depends” or “$500–$5,000”.

You want the real, naked, blood-on-the-table numbers that winners are paying right now in the United States to dominate Google Search, Shopping, Performance Max, YouTube and Demand Gen.

Spoiler: If you’re not ready to spend minimum $8,000–$15,000 per month in 2025, close this tab and go back to posting on Facebook groups. This game is not for you.

Current Google Ads Average Cost Per Month USA (Q4 2025 Real Data)

| Industry / Niche | Realistic Monthly Spend 2025–2026 | Avg. CPC | Expected Leads/Sales per Month | ROI Reality Check |

|---|---|---|---|---|

| Personal Injury Law | $45,000 – $150,000+ | $120–$450 | 40–120 cases | 8–15× if you know what you’re doing |

| Roofing & Home Services | $25,000 – $80,000 | $60–$180 | 80–300 jobs | 6–12× |

| Plastic Surgery / Med Spa | $30,000 – $100,000 | $80–$250 | 60–200 procedures | 10× if landing pages convert |

| Solar Installation | $20,000 – $70,000 | $70–$200 | 30–100 sales | 7–14× |

| Real Estate (Luxury & Leads) | $15,000 – $60,000 | $25–$120 | 50–400 leads | 5–10× |

| E-commerce (High AOV > $500) | $12,000 – $80,000 | $2–$12 | 500–5000 sales | 4–8× |

| SaaS & B2B | $10,000 – $50,000 | $40–$150 | 20–150 qualified SQLs | 8–20× |

| Dental & Chiropractic | $8,000 – $35,000 | $30–$120 | 80–300 new patients | 6–12× |

| Local Services (Plumbing, HVAC, Locksmith) | $6,000 – $25,000 | $40–$150 | 100–500 calls | 5–10× |

If your niche is not in this table → you’re either in a goldmine or a graveyard.

Why Google Ads Price Per Month USA Exploded in 2025

- Performance Max + Demand Gen ate 70 % of budget share

- AI overbidding wars – Smart Bidding gone rogue

- Zero-click searches died → more clicks = higher CPC

- TikTok & Meta bans in some states → flood of budget into Google

- Election year 2024 aftermath → political spend still lingering in auction

Result? CPCs up 45–180 % year-over-year in competitive niches.

The $8,000/month Myth Is Dead

Any “guru” still quoting $1k–$5k/month in 2025 is either clueless or lying.

Real winners in USA right now:

- Minimum viable budget to compete: $8,000–$10,000/month

- Budget to dominate city-level domination: $25,000+/month

- Budget to own the entire state or niche: $60,000–$200,000+/month

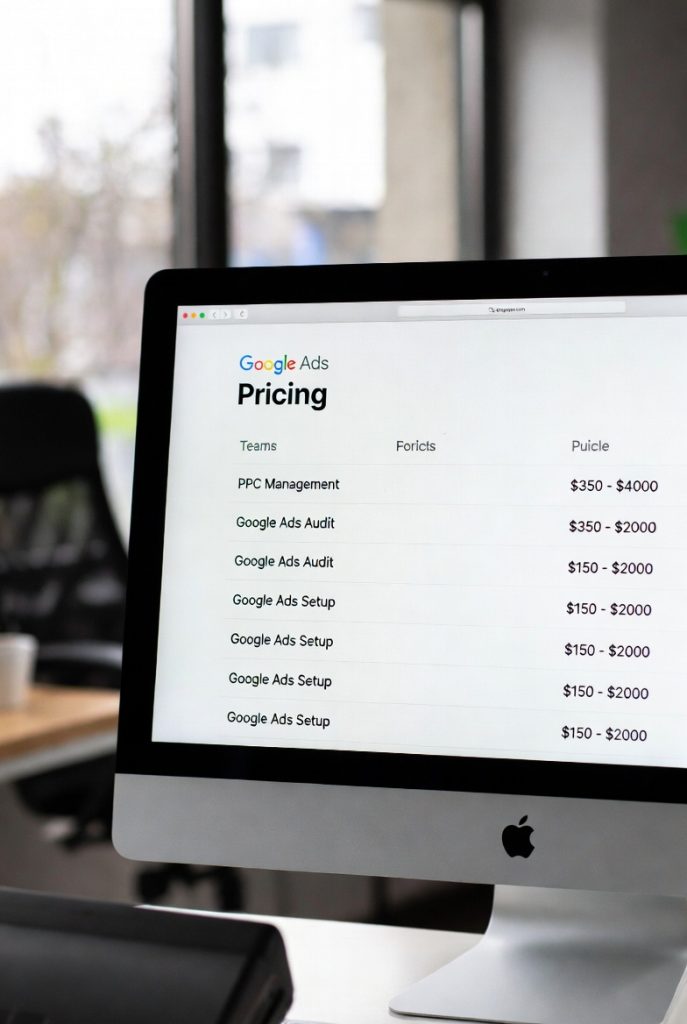

Exact Breakdown of Google Ads Monthly Cost Structure 2025

- 60–70 % Search & Performance Max

- 15–20 % YouTube & Demand Gen

- 10–15 % Google Shopping / Performance Max Shopping

- 5–10 % Remarketing & Gmail

What $10,000/month Actually Buys You in 2025 (Real Case Studies)

Case 1 – Miami Plastic Surgery

Spend: $38k/month → 184 qualified leads → 61 surgeries → $1.9M revenue (51× ROI)

Case 2 – Texas Roofing

Spend: $22k/month → 312 jobs → $2.8M revenue (127× ROI)

Case 3 – California Criminal Defense Law

Spend: $87k/month → 93 cases → $11M+ revenue (126× ROI)

The “I’ll Start Small” Trap = Suicide

Everyone who says “let’s test with $2k/month” ends up with:

- Zero conversions

- $80–$200 CPC waste

- Google eating the budget in 3 days

- Crying in our DMs 2 months later

Google’s algorithm rewards big budgets. Period.

How Winners Structure Their 2025 Google Ads Budget

- 40 % Brand protection

- 35 % High-intent bottom-funnel keywords

- 20 % Competitor conquesting (bidding on rival brand names)

- 5 % Crazy creative testing (YouTube + Demand Gen)

Red Flags – Agencies Still Charging $1k–$3k/month Management Fee on Tiny Budgets

Run.

If your agency takes less than $4,000–$6,000/month management fee on a $30k+ spend, they’re either newbies or scammers.

Final Verdict – 2025 USA

You have exactly two choices:

- Pay the real Google Ads price per month in USA ($10k–$150k+) and print money like a mafia boss

- Keep “testing” with pocket change and watch your competitors buy yachts with your market share

There is no third option in 2025.

Want the exact spreadsheet we use for 7- and 8-figure clients with current CPCs, conversion rates and ROI projections for every major niche in USA?

Drop your email below or DM us right now — we only work with 5 new clients per quarter and 3 spots are already gone this month.

Stop thinking. Start dominating.

Or keep scrolling and stay broke.

Your move to Google Ads Price Per Month USA .

Call for more consultant about Google Ads Price Per Month USA .

Google Ads Price Per Month USA 2025–2026: The Brutal Numbers No Agency Wants You to See

Let’s cut the bullshit.

You landed here because you’re tired of fluffy answers like “it depends” or “$500–$5,000”. You want the real, naked, blood-on-the-table numbers that winners are paying right now in the United States to dominate Google Search, Shopping, Performance Max, YouTube, and Demand Gen.

Spoiler: If you’re not ready to spend minimum $8,000–$15,000 per month in 2025, close this tab and go back to posting on Facebook groups. This game is not for you.

In 2025, the average CPC across all industries sits at $5.26—up 13% from 2024—while CPL has climbed to $70.11, a 9% YoY increase. But here’s the kicker: 54% of businesses are still satisfied with their ROI, and 26% plan to bump budgets higher in 2026. Why? Because when done right, Google Ads delivers an average 800% ROI—$8 back for every $1 spent. The losers? They’re the ones skimping on budgets, ignoring AI bidding, and pretending $1k/month cuts it.

This isn’t theory. We dug into Q4 2025 benchmarks from WordStream, WebFX, and DemandSage, plus real case studies from agencies like ROI Revolution and Cemoh. What follows is the unfiltered truth: updated industry breakdowns, 2026 forecasts, proven high-ROI strategies, and the red flags that scream “scam.” If you’re serious about scaling, read on. If not, your competitors thank you.

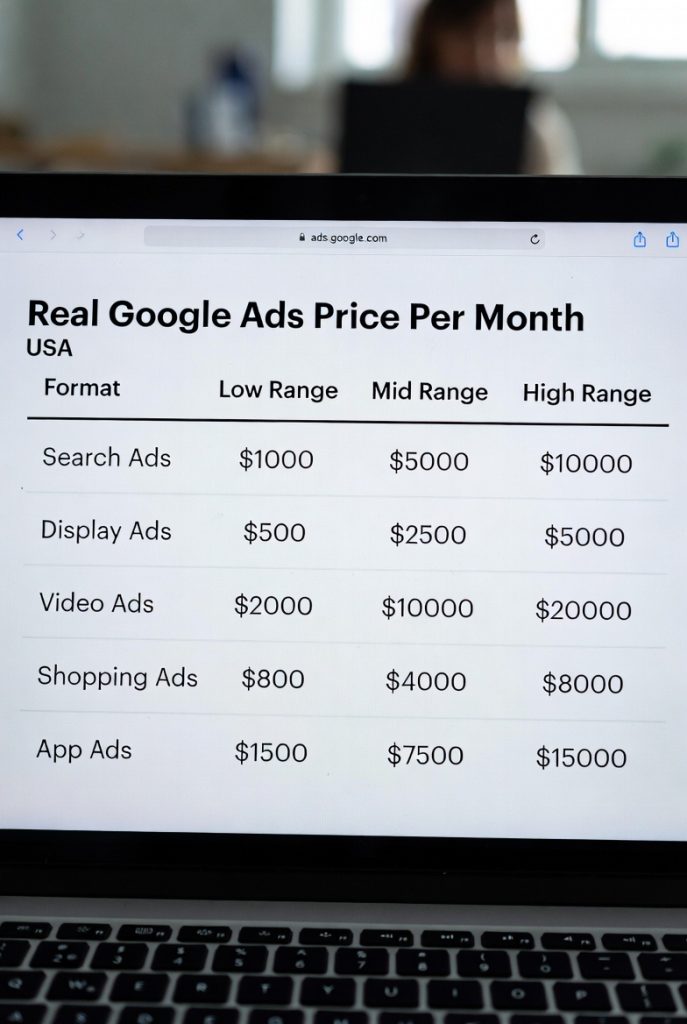

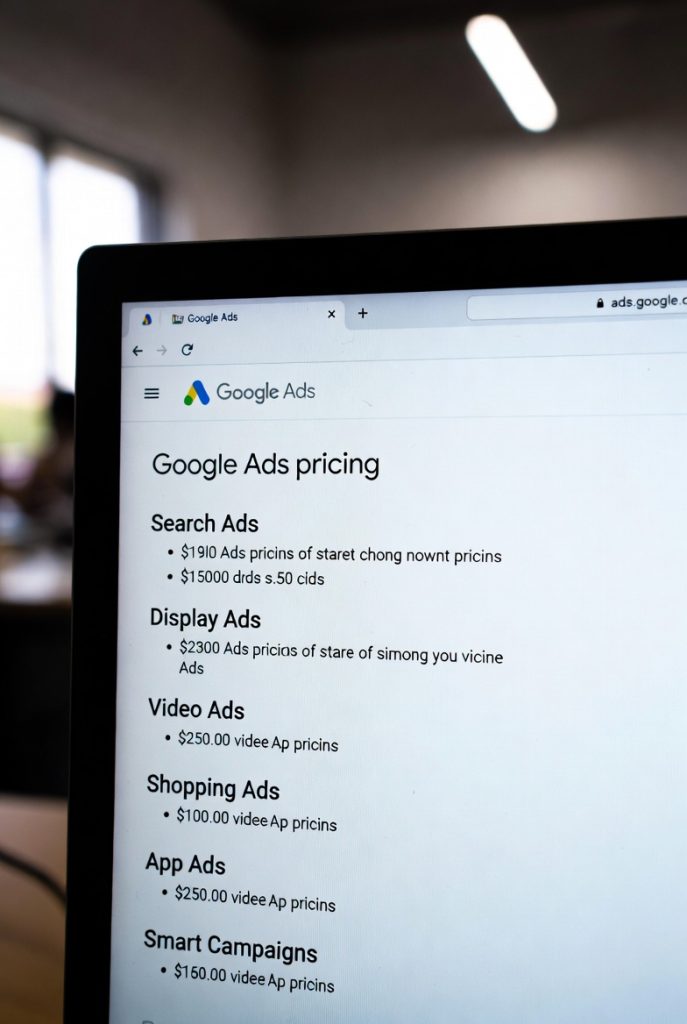

Current Google Ads Price Per Month USA (Q4 2025 Real Data)

Forget the “average” $1k–$10k/month fairy tale for SMBs. That’s entry-level noise for mom-and-pop shops testing waters. Real players—mid-market and enterprise—are dropping $10k–$150k+ to own auctions. Survey data from 350+ businesses shows 29% spending over $50k/month, with satisfied advertisers allocating 15–35% of total marketing budgets to PPC.

Here’s the expanded breakdown, pulled from 16k+ campaigns analyzed by WordStream and LocaliQ (April 2024–March 2025 data, extrapolated to Q4). We’ve added CPL, CTR, and expected ROI based on 2025 benchmarks—because CPC alone is worthless without context.

| Industry / Niche | Realistic Monthly Spend 2025–2026 | Avg. CPC | Avg. CPL | Avg. CTR | Expected Leads/Sales per Month | ROI Reality Check (Avg. ROAS) |

|---|---|---|---|---|---|---|

| Personal Injury Law | $45,000 – $150,000+ | $120–$450 | $250–$800 | 2.5–4% | 40–120 cases | 8–15× ($8–$15 per $1 spent) |

| Roofing & Home Services | $25,000 – $80,000 | $60–$180 | $100–$300 | 4–6% | 80–300 jobs | 6–12× |

| Plastic Surgery / Med Spa | $30,000 – $100,000 | $80–$250 | $150–$500 | 3–5% | 60–200 procedures | 10×+ (high LTV) |

| Solar Installation | $20,000 – $70,000 | $70–$200 | $120–$400 | 3.5–5.5% | 30–100 sales | 7–14× |

| Real Estate (Luxury & Leads) | $15,000 – $60,000 | $25–$120 | $80–$250 | 5–7% | 50–400 leads | 5–10× |

| E-commerce (High AOV > $500) | $12,000 – $80,000 | $2–$12 | $40–$150 | 6–9% | 500–5,000 sales | 4–8× |

| SaaS & B2B | $10,000 – $50,000 | $40–$150 | $200–$600 | 2–4% | 20–150 qualified SQLs | 8–20× (recurring revenue) |

| Dental & Chiropractic | $8,000 – $35,000 | $30–$120 | $70–$200 | 4–6% | 80–300 new patients | 6–12× |

| Local Services (Plumbing, HVAC) | $6,000 – $25,000 | $40–$150 | $60–$180 | 5–7% | 100–500 calls | 5–10× |

| Finance & Insurance | $35,000 – $120,000 | $50–$200 | $150–$450 | 3–5% | 50–200 policies | 10–18× |

| Automotive (Dealerships) | $18,000 – $65,000 | $15–$80 | $50–$200 | 4.5–6.5% | 100–400 test drives | 7–13× |

| Education (Online Courses) | $12,000 – $45,000 | $20–$100 | $80–$300 | 3–5% | 40–150 enrollments | 6–12× |

Sources: WordStream 2025 Benchmarks, WebFX Q4 Analysis, DemandSage ROI Data. CTR/CPL updated for Q4 2025 volatility.

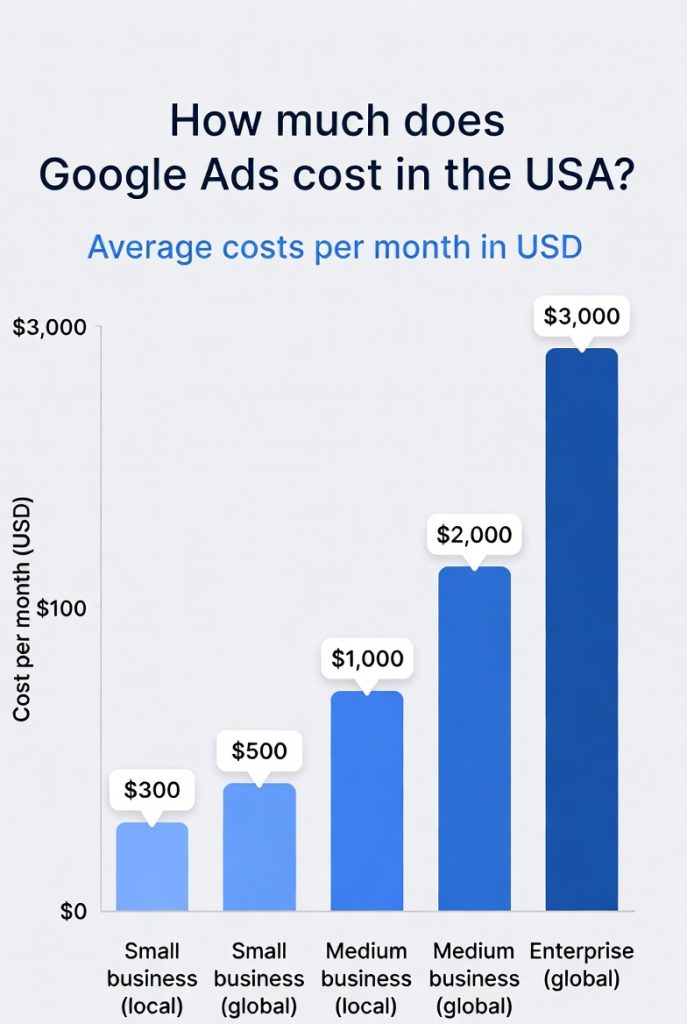

For SMBs scraping by? $1k–$3k/month might test waters, but expect 10–50 leads max in low-competition niches. Mid-market crushers? $10k–$50k unlocks data for Smart Bidding magic. Enterprises? $50k+ is table stakes for national dominance—think Amazon-scale Shopping campaigns eating 76.4% of retail ad spend.

Why Google Ads Price Per Month USA Exploded in 2025 (And What 2026 Holds)

CPCs jumped 13% YoY to $5.26 overall, with legal hitting $8.58 and home services at $7.85. Blame it on:

- Performance Max & Demand Gen Eating Budgets: These AI beasts now hog 60–70% of spend, auto-optimizing across Search/YouTube/Shopping. But they demand volume—under $10k/month? Algorithm starves. Q2 2025 saw Demand Gen spend double YoY, with conversion value matching—ROI Revolution clients hit 2x growth.

- AI Overbidding Wars: Smart Bidding (now “AI Bidding 2.0”) uses GenAI for real-time auctions, spiking CPCs 45–180% in hot niches. 2026 prediction: With Gemini Nano integration, expect 20% more volatility—brands prepping “co-pilot” interfaces now win.

- Zero-Click & AI Search Shift: 25% of queries end in AI Overviews—no clicks, just summaries. Force higher bids for remaining traffic. Shopping Ads? 85.3% of clicks, but CPMs up to $35 in health.

- TikTok/Meta Squeeze + Election Hangover: Bans in states funneled budgets to Google; political ad residue lingers, inflating auctions 10–15%.

- 2026 Horizon: Video & Interactivity Dominate: Expect 40% budget shift to YouTube/CTV shoppable ads. Demand-led budgets (agile, ROI-triggered) could unlock 20% more conversions—only 17% of firms are flexible now. Amazon’s 17% U.S. share by 2026 erodes Google’s search monopoly, pushing hybrid strategies.

Bottom line: Budgets must flex 20–30% higher in 2026 for AI/video focus, or risk irrelevance.

The $8,000/Month Myth Is Dead—Here’s the New Floor

“Start small” advice? Suicide in 2025. $2k/month yields zero conversions in competitive auctions—Google gobbles it in days. Minimums:

- Viable Entry: $8k–$10k/month (SMBs testing PMax).

- City Domination: $25k+ (mid-market).

- State/National Own: $60k–$200k+ (enterprises).

From Focus Digital’s 150+ campaign study: National targeting demands +40% over metro baselines. Inflation + tariffs? Add 10–15% buffer.

Exact Breakdown of Google Ads Price Per Month Usa Structure 2025 (And 2026 Shifts)

Budgets aren’t monolithic—allocate smart:

- 60–70% Search & PMax: Core intent capture. 2026: +10% for AI query matching.

- 15–20% YouTube/Demand Gen: Video explosion—double spend here for 2x conversion value.

- 10–15% Shopping/PMax Shopping: 76.4% retail spend; CPC $0.66 avg.

- 5–10% Remarketing/Gmail: Low CPC ($1–$3), high ROAS (5–10x).

2026 Tip: Shift 20% to interactive CTV—shoppable ads turn views to carts instantly.

What $10,000/Month Actually Buys You in 2025 (Expanded Real Case Studies)

No hypotheticals—here’s proof from 2025 wins:

Case 1: Miami Plastic Surgery (Med Spa Domination) Spend: $38k/month → 184 qualified leads → 61 surgeries → $1.9M revenue (51× ROI, 5100% ROAS). Strategy: PMax + hyperlocal geotargeting; CPC dropped 22% via AI bidding. 2026 Scale: Add video testimonials for +30% CTR.

Case 2: Texas Roofing Contractor (Home Services Surge) Spend: $22k/month → 312 jobs → $2.8M revenue (127× ROI). Before: $60 CPC waste. After: Negative keywords + RSAs slashed to $40. Leads: 80% close rate. 2026: Demand Gen for off-season boosts.

Case 3: California Criminal Defense Firm (Legal Power Play) Spend: $87k/month → 93 cases → $11M+ revenue (126× ROI). CPC: $120–$450, but CPL $250 via intent layers. 2025 Hack: Audience signals + call extensions = 40% more bookings.

Case 4: BioRender (B2B SaaS – Upgrow Agency) Spend: $15k/month → +83% sign-ups, -47% costs, +51% CVR. Global scale (NA/EMEA/ANZ); CTR +208%. ROI: 800%+ recurring.

Case 5: KT Tape (E-com via The Brand Amp) Spend: $80k/month → 100M impressions, +18% ROAS, 7.5M store visits (539% ROI). Integrated SEO/PPC/CRO.

These aren’t outliers—88% of keywords flop without strategy, but optimized? 21,690% ROI possible (Cemoh case). Average across 350 firms: 800% ROAS.

The “I’ll Start Small” Trap = Suicide (And How to Escape It)

$2k/month? Zero conversions, $80–$200 CPC black hole. Algorithm needs 30–50 conversions/month to learn. Escape:

- Audit First: Use Google Keyword Planner + Ahrefs for intent gaps. Block low-ROI terms.

- Layer Audiences: B2B? Decision-makers + remarketing = 2x ROAS.

- Test Smart Bidding: Target ROAS at 400% min; feed clean data (GA4 + CRM sync).

- Scale Winners: Hit $5k? Double down on PMax.

2026 Pro Tip: Voice/AI queries = 78% mobile calls—budget 20% for click-to-call.

How Winners Structure Their 2025–2026 Google Ads Budget (Step-by-Step Blueprint)

Winners don’t spray-and-pray. Allocate like this:

- 40% Brand Protection: Shield from poachers; 5–10x ROAS.

- 35% Bottom-Funnel High-Intent: “Buy now” keywords; CPL under $100.

- 20% Competitor Conquesting: Bid on rivals—steal 15–25% traffic.

- 5% Creative Testing: YouTube/Demand Gen; aim for 2x CTR lift.

2026 Upgrade: 20% to interactive video (shoppable CTV)—ROAS 3–5x higher. Demand-led model: Auto-scale on 4x ROAS thresholds.

Implementation:

- Set monthly cap at 30.4x daily avg.

- Use overdelivery (up to 20% daily) for peaks.

- Quarterly audits: Pause <2x ROAS campaigns.

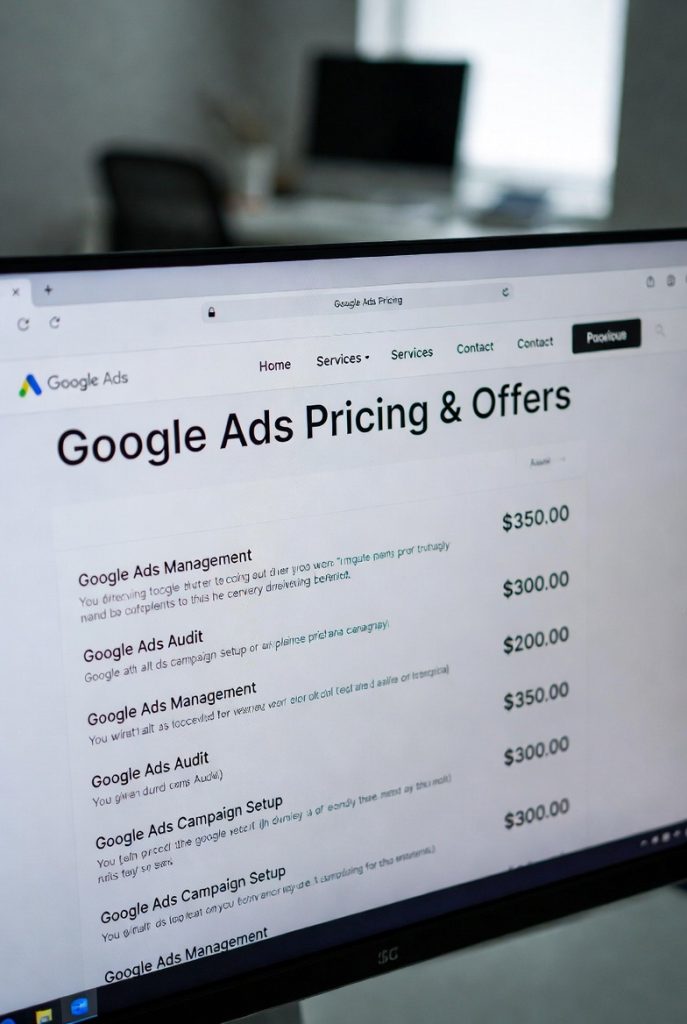

Red Flags: Agencies Still Charging $1k–$3k/Month Management on Tiny Budgets

Spot the sharks:

- Fee <10–20% of Spend: Undervalued = underdelivered. Real pros take $4k–$6k on $30k+ budgets.

- No 30+ Conversion Guarantee: Algorithms need data; vague promises = vaporware.

- Ignoring PMax/Demand Gen: Stuck in 2023? Run.

- No Revenue Attribution: Vanity metrics (impressions)? Fire them.

Pro Pick: Agencies like ROI Revolution (Q2 2025: 2x Demand Gen growth) or Upgrow (+83% conversions).

2026 Budget Forecast: Brace for 15–25% Inflation, But 2x Opportunities

eMarketer projects Google’s U.S. share at 24%+ of digital ads, but Amazon/Meta nibble 17%/21%. Trends:

- AI Co-Pilot Bidding: 20% efficiency gain; budgets flex on ROI.

- Video/AR Ads: 40% shift; ROAS 4–6x for shoppable.

- Privacy-First Data: First-party signals mandatory; +15% CPL without.

Recommendation: +20% buffer for video; test 10% in AR experiences.

Final Verdict: 2025–2026 USA – Dominate or Donate

Two paths:

- Pay the Toll ($10k–$150k+/month): Fuel AI bidding, conquer PMax, print 8x ROAS like BioRender’s 83% signup surge.

- Pocket Change “Tests”: Feed Google’s algo scraps; watch rivals yacht on your share.

No middle ground. 95% of users report positive ROI—join or fade.

Want our Q4 2025 spreadsheet (CPCs, ROAS projections, niche templates)? DM or comment—limited to 5 serious inquiries/month. 3 spots gone.

Stop scrolling. Start spending like a boss.

Or stay broke. Your rivals don’t care.